Sell put option calculator

Put Option Calculator Buy Option Strike Price. The strike price definition is the same here but for a different purpose.

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Option value calculator Calculate your options value.

. To start select an options trading strategy. The inputs that can be adjusted are. To create a covered put strategy add a short stock and a short put position to the.

An option to buy a stock at a certain cost is a call while an option to sell a stock at a certain price is a put. For example if ABC shares trade for 35 you could execute the put option that lets you sell. To find the maximum gain you have to exercise the option at the strike price.

Price volatility strike price risk. You can calculate your savings with the Brokerage. Bullish Limited Profit Nearly Unlimited Loss A simple but.

Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. To put it simply say you buy 20 lots of call options on the NIFTY in one order. Download The Option Profit Calculator If youre a put buyer use the Long Put tab and if youre a put seller use the Short Put tab.

Then simply enter the strike price the number of. Strike price of a put option. Using the fair value calculator that comes with OptionWeaver this stock has a fair value of 3333.

Turn Your Trading Record Around. Open an Account Now. Searching for Financial Security.

Copies of this document may be obtained from your broker from any. Ad Patented Covered Call Option Search Engine. With this input the stock.

Disappointed With Your Returns. As long as ABC corp shares trade below 40 your put option would be considered in-the-money. Stock Price at Expiration.

Basic Long Call bullish Long. Simply enter any brokerage fees you will have for buying or selling options contracts. Options Profit Calculator provides an unique method to view the returns and.

The strike price is 55 so you enter 5500 55 strike price 100 shares per option on the opposite. The Covered Put Calculator can be used to chart theoretical profit and loss PL for covered put positions. Total Fees Paid The fees field is pretty straightforward.

A put spread or vertical spread can be used in a volatile market to leverage anticipated stock movement while also providing. The put option profit or loss formula in cell G8 is. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Suppose that after deeper analysis you decide the business is solid and that youd. Put Spread Calculator shows projected profit and loss over time. Put Option Calculator is used to calculating the total profit or loss for your put options.

What is a short put. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. The long put calculator will show you whether or not your options are at the money in the money or out.

Where cells G4 G5 G6 are strike price initial price and underlying price respectively. Open an Account Now. Ad Ensure Your Investments Align with Your Goals.

Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days. Short Put Calculator Search a symbol to visualize the potential profit and loss for a short put option strategy. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

The result with the inputs shown. This option premium calculator is able to swiftly calculate the rate of return for covered calls and cash-secured puts and also can determine the fair value of a stock. The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model.

Learn To Sell Covered Calls. When the underlying asset price goes below the strike. Put option calculator.

Parameter Value GainLoss -10000 GainLoss -800 Other. Price Per Option. Our Financial Advisors Offer a Wealth of Knowledge.

Find a Dedicated Financial Advisor Now. With SAMCO your brokerage will be Rs20 for the entire order.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

What Is Call Option And Put Option A Beginner S Guide

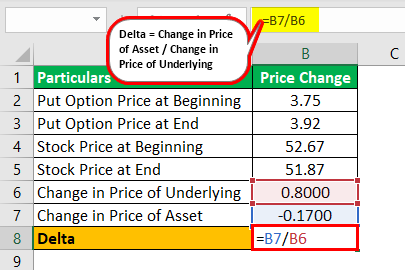

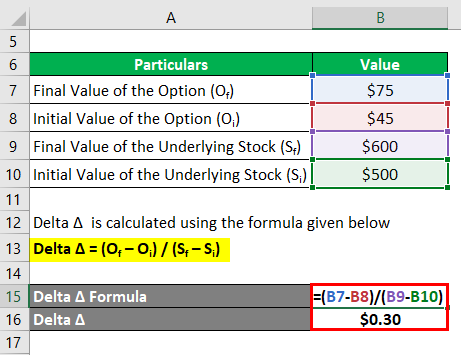

Delta Formula Calculator Examples With Excel Template

Delta Formula Definition Example Step By Step Guide To Calculate Delta

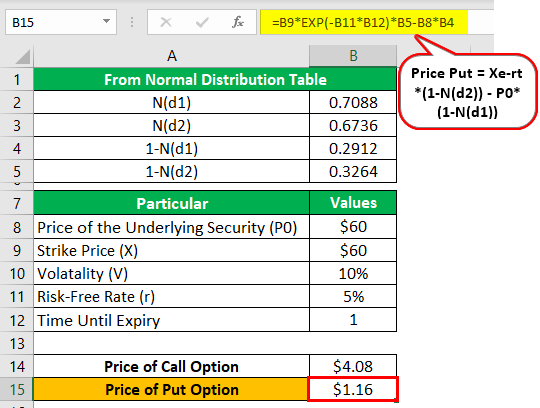

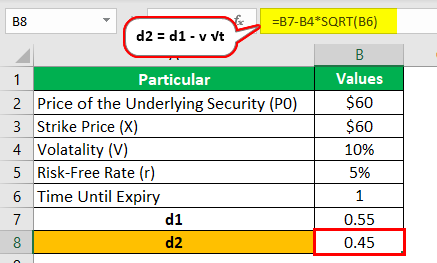

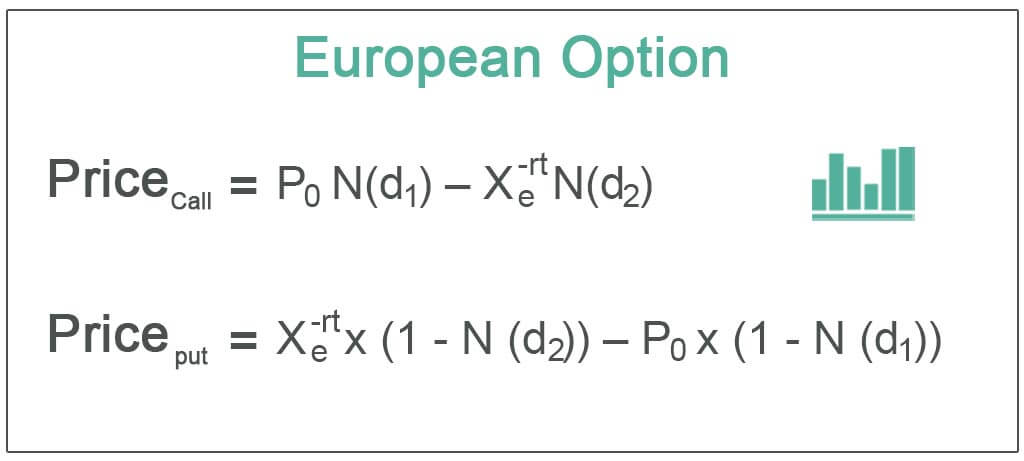

European Option Definition Examples Pricing Formula With Calculations

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Call Option Calculator Put Option

Understanding The Binomial Option Pricing Model

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-02-7a6cec73fd1b4bbd877e5c61d8186b04.jpg)

Options Basics How To Pick The Right Strike Price

How And Why Interest Rates Affect Options

European Option Definition Examples Pricing Formula With Calculations

Delta Formula Calculator Examples With Excel Template

Options Buying Vs Selling Which Strategy To Use Trade Brains